The "VE" Fat Middle Thesis

How yield boosting middle dApps will capture the most growth in this VE-season.

Introduction

The Curve wars have been one of the most talked about events in decentralized finance (DeFi). The reason for this conflict is that protocols (as well as decentralized exchanges (DEXs)) want deep liquidity for their token, since it: 1. helps increase demand/usage for the token/stablecoin, 2. reduces friction when trading and 3. creates a moat around the liquidity pool making it difficult to manipulate. In order to do this there needs to be incentives for Liquidity Providers (LPs). Traditionally, automated market makers (AMMs) simply printed their own token as a “Liquidity Mining” (LM) reward for LPs. Unfortunately, you can’t just print tokens out of thin air and most of these LM rewards are dumped on the market, losing their value. Then came the idea of staking these tokens for additional rewards, and while this worked for a certain period of time, ultimately people continued to farm and dump on this model as well.

Curve offered the Vote Escrow (VE) model, where tokens were locked for a certain period of time. The greater the volume of Curve tokens (CRV) plus the longer the time results in a greater boost in LM rewards for LPs. Furthermore, VE-tokens are used for governance to determine which pool receives LM rewards (called the gauge). The combination of locking, boosting and governance gives the token more utility and thus makes it more coveted by LPs and protocols who have pools in Curve. Although it hasn’t fully solved the problem of farming and dumping, it has created a ticking time bomb and delayed the problem for later.

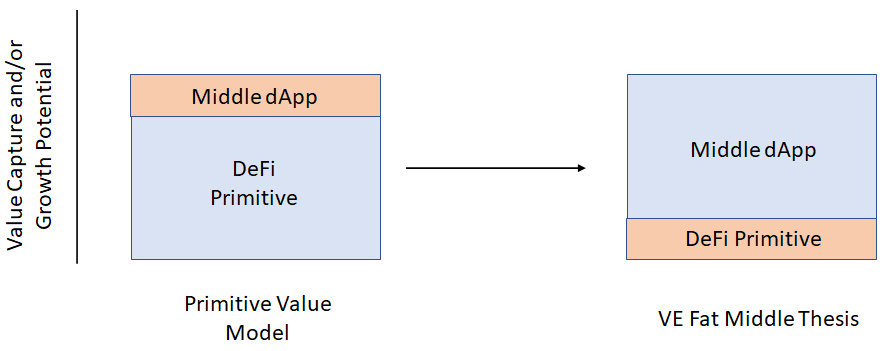

The other aspect of Curve’s tokenomics achieved by combining these utilities in a single token, is that it allows for boosting services to be built on top, acting as a middleman. Convex Finance (CVX token) entices CRV holders to permanently lock their CRV tokens in exchange for Convex revenues, and by doing so they can also offer LPs instant boosts without having to deal with buying and locking CRV tokens. With almost 50% of the CRV tokens locked forever in Convex, it is becoming increasingly evident that these middle decentralized applications (dApps) are the kingmakers for these AMMs. Here I make the argument that in VE tokenomics, it is tokens for these middle dApps that will see the largest growth and potentially market cap compared to the tokens of their respective underlying DeFi primitive (figure below). I call this “The VE Fat Middle Thesis”, which is an obvious reference to the Fat Protocol Thesis.

A New Model for DeFi

The recent focus on Curve came from the tweet (below) by Terra founder Do Kwon, and his launch of the 4-pool with Frax Finance and Redacted Cartel. This was an obvious attempt to dethrone the very liquid 3-pool as the dominant stablecoin pool on Curve and to replace DAI with UST and FRAX as the dominant algorithmic stablecoins.

While focus has been on the Curve and these corresponding protocols, the real winner will likely be Convex. Terra and Frax are offering huge bribes to people with locked Convex (i.e. governance votes) and Redacted Cartel has been offering Convex bonds for a while. The following are the reason I think Convex (and similar protocols) could see huge growth in the VE model:

Boost service and yield bearing assets: The first is the most obvious, it gives LPs an instant boost without having to deal with CRV tokens and allows CRV token holders to trade their tokens for part of the protocol revenue.

Deep liquidity without dilution: From a protocol perspective, controlling the Curve gauge gives them the ability to reward LPs without using their own token/stablecoin. Essentially, inflating the circulating supply of CRV, while increasing their own liquidity without diluting their circulating supply. Who would not want to control this mechanism?

Asymmetric defense: With 40-50% of the circulating CRV supply locked by Convex and continuous locking, whatever is decided at Convex Governance is what will likely happen at Curve. Going against Convex and what is decided is not worth it, unless the party is willing to spend large sums of money to buy CRV.

Bribes: With bribe mechanisms like Votium, it is often cheaper for protocols to pay off Convex-locking-voters than it is to buy up Curve and compete with Convex. Also, with bribes, it incentivizes Convex holders to lock up their CVX, thus reducing circulating supply.

Tokenomics: Total supply of tokens from yield boosting protocols are often capped much lower than those of the underlying DeFi primitive. Furthermore, the usage of the bribes system will drive the process of locking CVX, whilst CRV can be used to farm and dump.

We’re Still Early

Early evidence suggests this thesis is playing out. Top section of the figure above, you can see the percentage change of Curve and a similar AMM with VE-tokenomics, Platypus Finance (PTP; on Avalanche) against their respective yield boosters: Convex and Vector Finance (VTX). It is pretty distinct that the yield boosters are outperforming their respective DeFi primitives. However, it is still early, Vector does have a competitor, Echidna Finance, who are behind on collecting the PTP token and thus didn’t fit this model at the time of writing. Both protocols have less than 20% of PTP circulating supply. Bottom section of the figure above, are the Coingecko rankings of Convex and Curve, showing $1.9B and $0.9B market caps, respectively. This further supporting the thesis that market cap of middle dApps will be higher.

There are a lot of new algorithmic stablecoins being launched (such as USN on Near and USD.thor on Thorchain). The problem with algo stablecoins is it is incredibly hard to hold peg without demand and deep liquidity. Stablecoin focused AMMs like Curve and Platypus are poised to have fierce competition for which of these stablecoin pools will have the deepest liquidity. Based on these observations, the growth of these middle protocols could be amplified.

Future of VE

The usage of the VE token model has proliferated to other applications, including algo stablecoin Frax Finance (Ethereum), generalized AMM Trader Joe (Avalanche) and soon collateral debt position (CDP) lending Yeti Finance (Avalanche). It would be interesting to see how VE-tokenomics play out on Uniswap V2 AMMs like Trader Joe, since they have a variety of tokens. Many protocols (without stablecoins) may opt to control the veJoe gauge to promote their own liquidity without diluting their market cap. Projects built on veJoe include Farmer Frank (which uses a node system, unlike Convex), Steak Hut Finance (a Convex fork), Yield Yak (a general yield aggregator which is currently in the lead and could greatly benefit from this) and Vector Finance (if they control Platypus and Trader Joe gauges, they could be kingmakers in the entire Avalanche ecosystem). So far there is cautious optimism in how many types of DeFi primitives can use this VE-token model.

Conclusions

Yield boosting applications built on top DeFi primitives with VE-tokenomics are poised to have greater growth than the underlying primitive, due to the benefit of the instant LP boosts, the ability for protocols to influence LM rewards toward their own pools, and the multiple sources of yield for VE-token holders (ie: Convex yield+Votium bribes). Without yield boosting protocols, like Convex, these DeFi primitives would end up like the rest of the farm and dump tokens. This model is expanding to encompass multiple types of DeFi protocols where deep liquidity is valued. In addition to bribe protocols, there are a number of projects attempting to build on top of Convex. It is unclear if the fat middle thesis will expand to Layer 3s. The risk at that level is that it may be too far abstracted from the base DeFi dApp and may not have a clear purpose like Convex. Votium is one of the few third layer dApps that have a purpose.

Overall, VE is changing tokenomics. There is no doubt kingmakers are about to be built in this space, providing they continue to innovate and benefit users and protocols at the current pace.

Disclosures: I have financial interests in many of the projects mentioned in this article. I’ve implemented this thesis in my investment strategy. This post is for information purposes only and should not be taken as investment advice.

Special thanks to Samuel from alpha please for editing assistance. Follow their substack!

Comment here or on my Twitter @CanuckLink